Whether for the injection of biomethane into natural gas distribution or transport networks, or of renewable electricity into electricity distribution or transport networks, the State has chosen, in various decrees, to index purchase contracts on two coefficients K and L constructed from a weighted formula including two INSEE indices.

Regardless of the sector, the K coefficient is used for the initial indexing of the contract, while the L coefficient is used for annual indexing.

How do purchase contracts depend on INSEE indices?

The two INSEE indices are representative of the cost of labor and sectoral production prices.

The K coefficient varies 100%, 50% depending on labor cost and 50% depending on production prices.

For the L coefficient, however, there are two unequal variable parts of the labor cost and production prices (for example, 30% and 40% for biomethane injected into natural gas networks), to which a fixed part is added (for example 30% for biomethane injected into natural gas networks).

Why estimate INSEE indices rigorously?

Due to this strong dependence on the evolution of indices, it is imperative, to know the sales revenues of renewable electricity or biogas, to carry out a prudent simulation of the “step-by-step” INSEE indices, from their exact formula, as defined in the relevant decree.

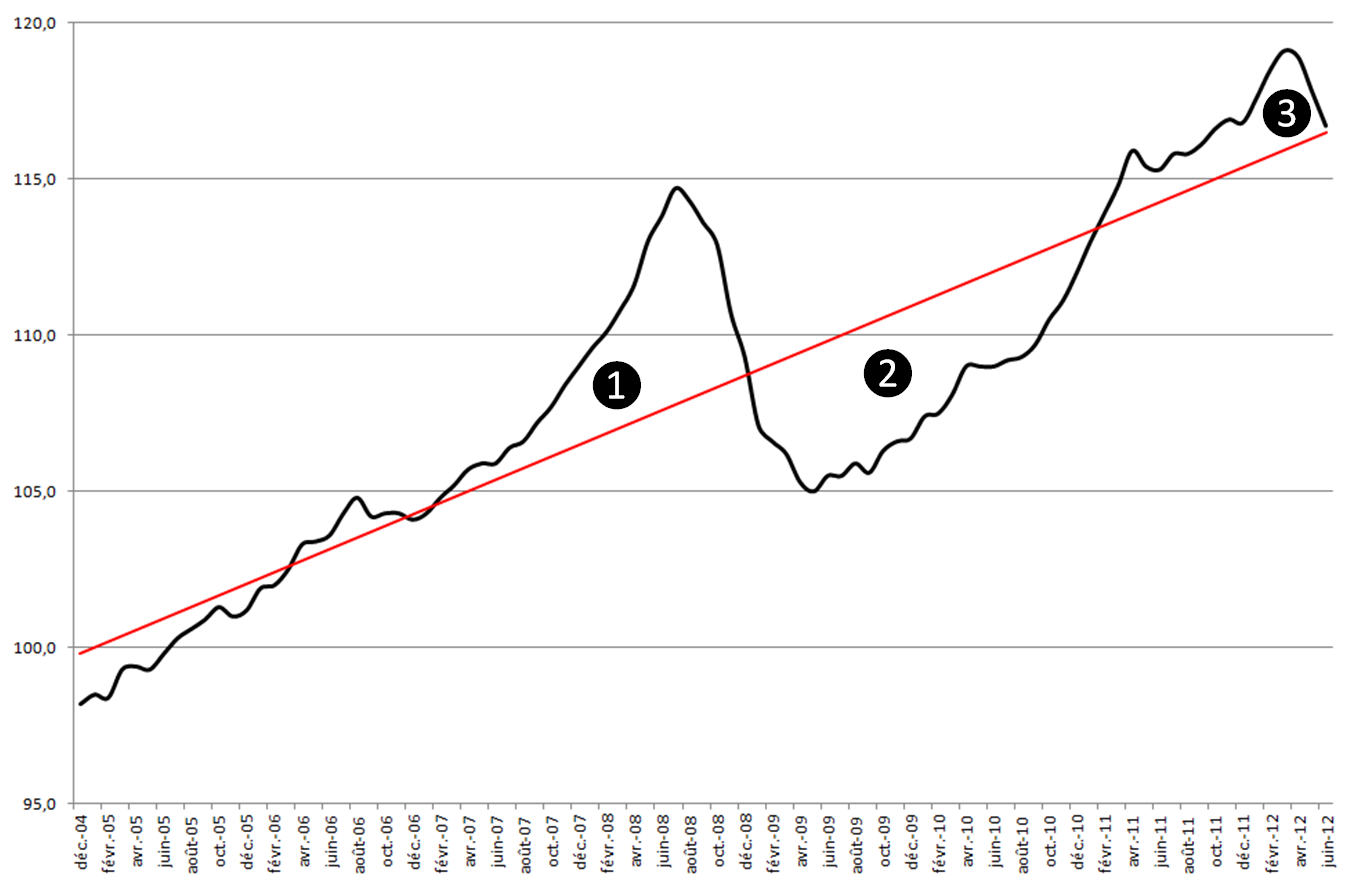

As an illustration, the graph below represents the observed evolution of the production price index over the period running from December 2004 to June 2012 (black curve), along with its trend curve (red).

This graph highlights notable “stylized facts”, linked to cyclical phenomena of the index, around its long-term (structural) trend:

- acceleration ❶ relative to the trend over the period from March 2006 to December 2008 (economic growth period) ;

- deceleration ❷ relative to the trend over the period from January 2009 to January 2011 (effect of the “subprime crisis” in France) ;

In June 2012 an acceleration phase ❸, which had started in February 2011, seems to be coming to an end.

Estimating the INSEE indices rigorously means seeking and relying on a good understanding of the macroeconomic determinants of these indices.

Our services

Zelya Energy accompanies you to:

- Carry out econometric simulations of the evolution of INSEE indices taking into account the different re-scaling coefficients between successive series ;

- To validate, calculate or estimate the applicable K and L coefficients ;

- Calculate annual tariff obligations and operating revenues, over the operating or valuation period ;

- Detail the calculation of the purchase price specifying the margins of uncertainty.