Zelya Energy specializes in transactions, acquisitions, and investment strategies in the energy sector. Our clients include investors, plant owners, and operators of gas and electricity networks.

For more than twenty years, we have leveraged our expertise, network, and tailored financial models to help clients optimize their acquisition strategies. We have been involved in numerous due diligence processes, mergers, acquisitions, and asset valuations, ranging from a few million to several billion euros.

Our main services for investors include:

Our dual expertise in finance and the energy industry allows us to provide comprehensive, multidisciplinary support to our clients.

Thanks to the experience and training of our experts, we deliver concise, fast, and high-quality outputs, perfectly adapted to the strategic and operational needs of our clients.

Examples of assignments

Financial valuation of a subsidiary of the French Power Transmission Network company

Technical and regulatory due diligence of solar and wind portfolios

Due diligence and asset valuation support for GRTgaz during its capital opening

Evaluation and due diligence of hydroelectric dams

Technical and economic audit for a full renovation of a wind farm

Due diligence of a combined cycle gas plant: assessment of gas supply and power price risks

Advisory support to the energy regulator in determining the cost of capital for gas and electricity infrastructure tariffs

Strategy consulting and business plan development in the merger of renewable power companies

Thermal power plants

Regulatory and commercial due diligence of several CCGTs totaling more than 2 GW across Europe

Assistance with financial valuation and connection to gas and electricity networks

Gas and electricity networks, storage

Due diligence of storage, LNG, and gas & power transport companies for multi-billion-euro investments

Technical and regulatory audits, validation of financial modeling assumptions

Photovoltaic

Technical and regulatory due diligence, financial evaluations

Projects from 3 MW to more than 100 MW, for clients such as Satcon, First Solar, Lampiris, Alpiq, Eneco, Caisse des Dépôts, European Energy...

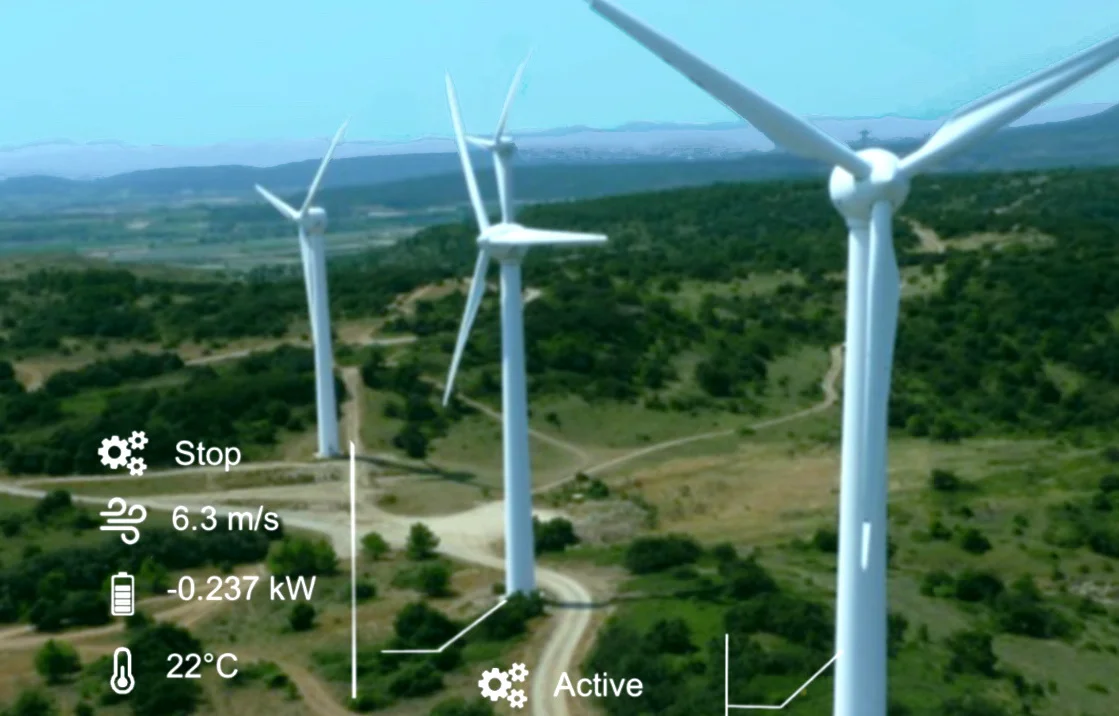

Wind energy

Financial evaluations, due diligence, technical audits

Performance optimization and evaluation software

Nearly 100 wind farms and projects, for clients such as BKW, Eos, SNCF, Lampiris, Alpiq, Eneco, Enfinity, Proener, Caisse des Dépôts...

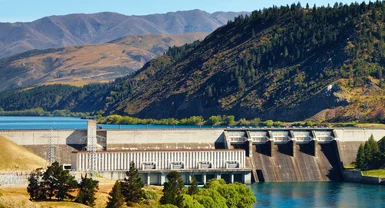

Hydropower

Analysis of potential output and business plans for 10 hydro concessions (8 to 84 MW)

Audits and re-evaluations of 32 hydro plants of a few MW each

Clients include Alpiq, Eos, Statkraft, Eneco, Enfinity, Caisse des Dépôts, GEG...

Information:

Call us at +33.4.93.71.33.11 or contact by Form