Our consultants support clients in the financial valuation of energy companies and assets in the context of acquisitions or equity investments.

We have built solid expertise and a strong reputation in this field, having contributed to the development of robust financial models and valuation methodologies tailored to diverse portfolios: wind, hydro, solar, biomass, thermal, networks, and more.

We apply the most appropriate valuation methods to the company’s activity, whether it is in steady-state operations or seeking financing to support growth. Our work is comprehensive, reflecting the specific nature of each company assessed, as well as the tax and accounting considerations unique to different energy sectors.

Valuation of Energy Portfolios

We address key investor concerns:

Types of energy assets, companies, and portfolios valued:

Our energy valuation services

Development of the Base Case standalone financial model for the target company or asset;

Validation of depreciation assumptions, costs, revenues, and taxation based on the asset type and market conditions;

Estimation of future generation capacity and sale prices, regulated or market-based;

Determination of the Weighted Average Cost of Capital by asset type and jurisdiction;

Valuation of the acquisition price.

Information:

Call us at +33.4.93.71.33.11 or contact by Form

Energy infrastructure and renewable assets valuation

Thermal Power Plants

Due diligence and valuation of combined-cycle gas turbine (CCGT) plants ranging from 400 to 860 MW.

Infrastructure

Financial modeling and valuation of gas storage companies, LNG facilities, and electricity and gas transmission networks, representing several billion euros in value.

Photovoltaic

Valuation of approximately 20 projects ranging from 3 MW to over 100 MW.

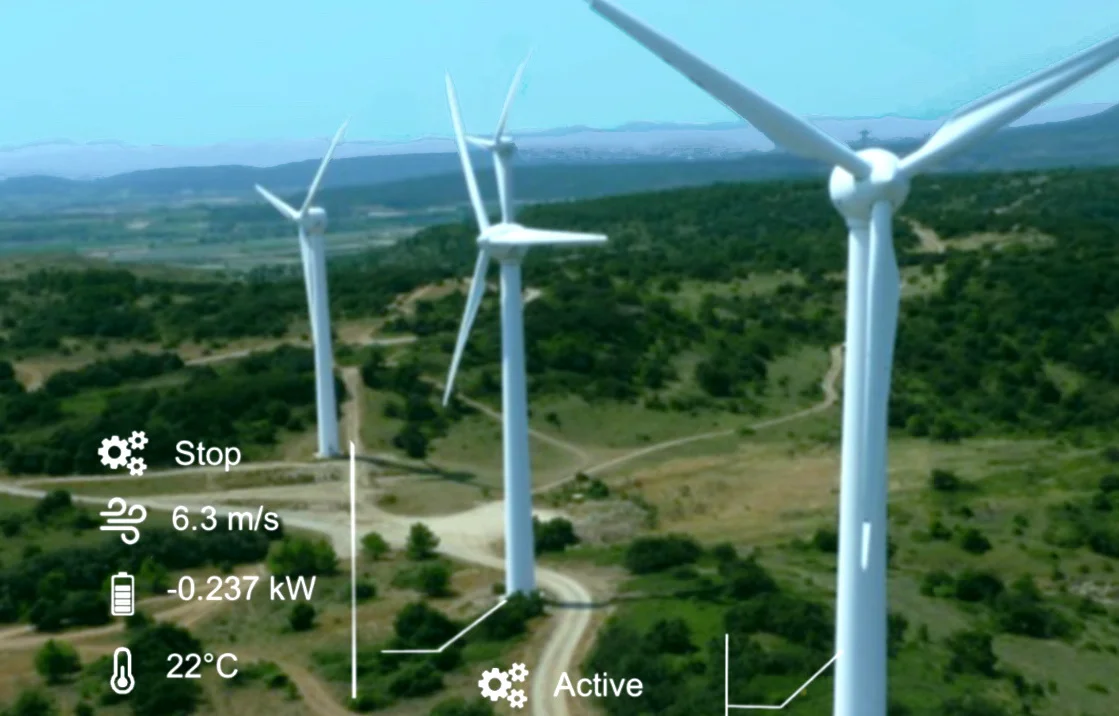

Wind

Valuation and technical audits of nearly 100 wind farms and projects.

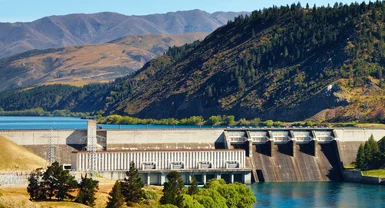

Hydropower

Business planning and financial modeling for a dozen hydro concessions due for renewal, ranging from 8 to 84 MW;

Audit and revaluation of 32 small-scale plants.